Stock Analysis: Apple’s 2015 earnings results

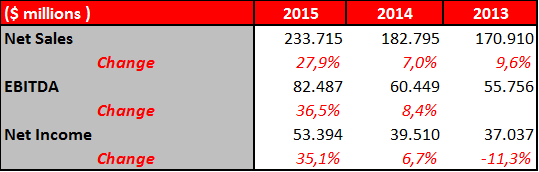

Apple’s earnings results in fiscal year 2015 are better than 2014 results. On yearly basis, Apple’s revenues have increased 27.9% in 2015 over 2014, reaching $233.7 billions.

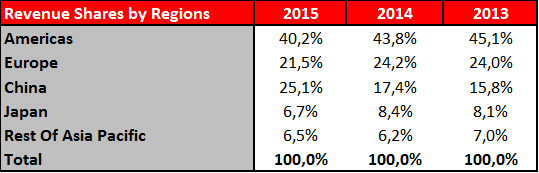

Based on regions, 40% of revenues came from Americas, followed by Europe and China with shares of 21.5% and 25.1%, respectively. China’s share increased in 2015 by 7.7 points in 2015, while shares of Americas and Europe decreased.

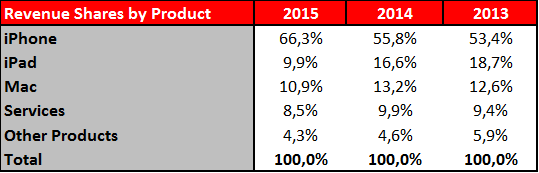

Based on products, share of iPhone sales in revenues increased to 66.3% in 2015 from 55.8% in 2014, but shares of other products decreased in 2015.

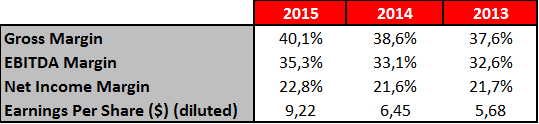

On the other hand, total costs increased by 24.8% YoY, less than increase in revenues, leading 32.7% increase in gross profit. Therefore, gross margin increased to 40.1% in 2015 compared to 38.6% in 2014. Since increase in gross profit is higher than increase in operating expenses, the company’s EBITDA increased by 36.5% YoY, moreover, EBITDA margin has increased to 35.3% in fiscal year 2015 from 33.1% in 2014. With high increase in profitability of operations provided largely by inccrease in revenues, company posted a $53.4 billions net profit in 2015, corresponding an increase of 35.1%.

Furthermore, diluted earnings per share increased to $9.22 in 2015 from $6.45 in 2014. Also, declared cash dividend increased to $1.98 from $1.82.