Why should you open an account at Betterment?

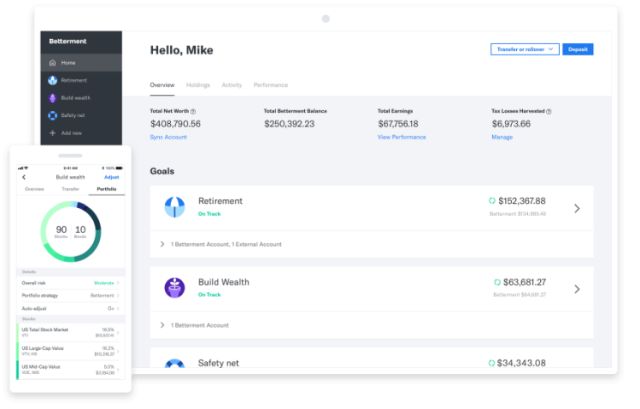

Betterment is one of the leading online financial advisors which firstly focus on your life interests by planning your financial goals and recommending investment options based on your risk profile and tolerance. It manages more than $15 billion money with almost 400K users. When managing portfolios, Betterment doesn’t focus on just returns, but also on after tax-returns.

Betterment forms your portfolio, and take care of rebalancing your portfolio, reinvesting dividends, and getting benefits from tax advantages for you. For these processes, Betterment as a robo-advisor uses technology and automate them in order to help you to have better investments. Thus Betterment is especially best for people who don’t have enough information about investing and have no time to learn investing.

Betterment helps you for the following financial goals:

- Planning for retirement

- Planning for buying home

- Investing for your child’s future

- Rolling over your old retirement plans to get maximum returns from your money

- Receiving an inheritance

- Protecting you against market fluctuations

- Setting a financial goal for you if you don’t have

In Betterment, you have two main investment account options as Digital and Premium. Both also have discounts. All portfolios in these accounts consists of ETFs. There is no other asset groups in Betterment portfolios. In addition, in these investment options, there is no additional trading and transfer fees.

Digital account’s features are:

- Personalized financial advice

- Low-cost, globally diversified investment portfolios

- Automatic unlimited rebalancing

- Advanced tax-saving strategies

- Synchronization of external accounts to get a clear view of your money.

- No minimum account balances

- A 0.25% annual fee

- A discount of 0.10% for account balances over $2 million.

Premium account’s features are:

- All the benefits of Digital account

- In-depth advice on investments outside of Betterment

- Unlimited access to Betterment’s CFP® professionals for guidance on life events such as getting married, having child, managing equity-based compensation, retiring, etc.

- $100,000 minimum account balances

- A 0.40% annual fee

- A discount of 0.10% for account balances over $2 million.